what are roll back taxes in sc

Why does Abbeville County charge these taxes. Is there a tax break for agricultural property.

Pin On Mariana Long Hair Styles Evening Hairstyles Short Hair Styles

Under prior law rollback taxes were accessed for a five-year period.

. The start of a new year frequently includes new or updated statutes and South Carolina is no exception. Section 12210 subsection 4 provides for a rollback and states the method to be used. If real property including mobile home has been sold.

Rollback taxes go back a maximum of 5 years from the year a change in property use has occurred. The property has been owned by current owner or immediate family member of the current owner for at least ten years ending January 1 1994 and the property is classified as agricultural real property for tax year 1994. If you have any questions regarding South Carolina rollback taxes please contact any of the following lawyers or your lawyer at Burr Forman LLP.

If you have any questions regarding South Carolina rollback taxes please contact any of the following lawyers or your lawyer at Burr Forman LLP. Each years tax is based upon the years appraisal and millage rate. To inquire about appraisal values on real property.

The request must be made in writing and contain the following information. Assessors Office must go back up to a period of five 5 years and collect those deferred taxes. It is the responsibility of the Assessor to provide the Auditors Office with the proper information for the rollback taxes.

Yes SC Law provides for a substantial tax break on agricultural real. 5693-712 4981 Rollback tax Rollback tax can go back 3 years. They are based on the difference between the tax paid and the tax that would have been paid if an agricultural use exemption had not been granted.

South Carolina General Assembly 123rd Session 2019-2020. South Carolina Code Section 12-43-220 requires that any time a property changes from receiving the benefit of an agricultural use special assessment ratio property tax exemption to any other use rollback taxes are. The Rollback tax is a requirement codified in South Carolina state law.

Anytime a property changes its use from agricultural use to any other use it causes rollback taxes to be assessed and billed to that portion of the property. 2021 brings an update to South. To amend section 12-43-220 as amended code of laws of south carolina 1976 relating to the classification and assessment ratios of certain properties so as to delete provisions relating to roll-back taxes.

The Rollback tax is a requirement codified in South Carolina state law. In determining the amounts of the roll-back taxes chargeable on real property which has undergone a change in use the assessor shall for each of the roll-back tax years involved. An act to amend section 12-43-220 code of laws of south carolina 1976 relating to classification of property and assessment ratios for purposes of ad valorem taxation so as to limit rollback taxes to three years when land classified as.

Roll-Back Tax bills are sent to the Owner of Record as of 1231 when the land use classification changed. Greenwood SC 29646-2634 Or fax to 864-942-8660 Or email assessorgreenwoodscgov NOTE. Rollback taxes are calculated on the difference between what was paid under agricultural use verses what would have been paid as nonagricultural property.

The amendment is effective January 1 2021. Why should I have to pay these taxes. A Brief Explanation The Rollback tax is a requirement codified in South Carolina state law.

What are rollback taxes. The Assessors Office will facilitate the estimate of Roll-Back Taxes that will be due. A rollback tax is collected when properties change from agricultural to commercial or residential use.

South Carolina Code Section 12-43-220 was amended in this years shortened legislative session to reduce the lookback period to three years. Primary residence farm or agricultural exemption discounts. This is state law and can be found in section 12-43-220 4 in the SC Code of Laws.

Out of a 10 acre tract 2 acres are sold. Changes that can trigger the rollback provision may. South Carolina Code Section 12-43-220 requires that any time a property changes from receiving the benefit of an agricultural use special assessment ratio property tax.

In the year the use changes the difference between tax paid under the agricultural use classification and the amount that would have been paid typically as commercial. SC Code of Law Section 12-43-220 4 When real property which is in agricultural use and is being valued assessed and taxed under the provisions of this article is applied to a use other than agricultural it is subject to additional taxes hereinafter referred to as roll-back taxes in an amount equal to the difference if any between the. Contact the Lexington County Tax Assessor 803 785-8190 for the following.

It is the responsibility of the purchaser and seller to agree upon whom is responsible for the Roll-Back Taxes. This is a SC State Law referenced in SC Code of Laws section 12-43-2204. 2020 Year Millage Rate 6 2018 0.

For changes of address for real property Real Estate Refund Requests. Maybank III Member at Nexsen Pruet LLC When agricultural real property is applied to a use other than agricultural it becomes subject to rollback taxes. Tax Map Number s Plat Reference s or New Proposed Plat.

When real property valued and assessed as agricultural property is changed to a use other than agricultural it is subject to additional taxes referred to as rollback taxes. Unfortunately the taxes follow the land and not the owner per State Law. And to repeal section.

In the year the use of the property changes the difference between the tax paid under. How are rollback taxes calculated. 5693-712 4981 Rollback tax Rollback tax can go back 3 years.

The difference is multiplied by the millage rate in the appropriate district and that results in the amount of tax due. Typically rollback taxes apply in transactions in which a developer is purchasing property for development that previously received the benefit of an agricultural use special assessment ratio property tax exemption. The Auditors Officer shall furnish the Treasurers Officer with the proper information to compute the rollback taxes.

Rollback taxes are equal to the difference if any between the taxes paid or payable. A Brief Explanation The Rollback tax is a requirement codified in South Carolina state law. Download This Bill in Microsoft Word format Indicates Matter Stricken Indicates New Matter.

Calculation of Rollback taxes For example. Questions regarding Rollback Taxes. Every county in South Carolina assesses rollback taxes when a change in previously agricultural property occurs.

The Auditors Officer shall furnish the Treasurers Officer with the proper information to compute the rollback taxes. The market value for these 10 acres is 20000 and the agricultural value is 3120. In the United States the owners of land used for residential or commercial purposes pay more.

Not As Rough As Some Of The Rock Star Books I Have Read I Loved The Story Of Jake And Aubrey And Especially Granny Jean Favorite Books Book Characters Books

Bn Collections Lighting Felix Forest Glass Light Fixtures Artistic Lighting Lamp Light

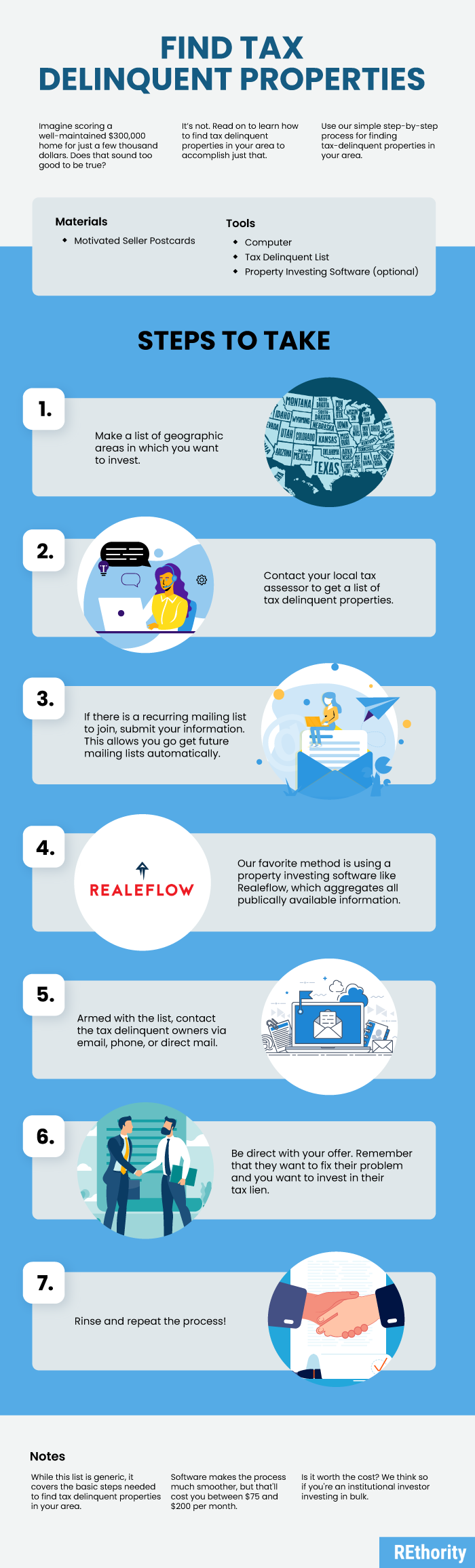

How To Find Tax Delinquent Properties In Your Area Rethority

2019 2020 Back To School Information For Fort Mill Sc School Information School Site Student Enrollment

Ci 121 Montana S Big Property Tax Initiative Explained

How Universities Are Spending Your Money Visual Ly Infographic College Info Tuition

Crochet Hat Pattern Roll With It Crochet Pattern For Etsy Slouchy Hat Pattern Crochet Hat Pattern Crochet

Tax Liens And Your Credit Report Lexington Law

How To Find Tax Delinquent Properties In Your Area Rethority

I Didn T See The Rolling Stones But I Did Go To Concerts At The Capital Centre It Is No Longer The Rolling Stones Concert Rolling Stones Concert Posters

Ci 121 Montana S Big Property Tax Initiative Explained

Lovely Leather Menus For Gregoryblakesamsevents In Charleston Sc Leather Flask Charleston

Rollback Tax Law In Sc Changes Effective January 1 2021 Let S Talk Dirt

Chain Bracelet With Michael Jackson Glove Charm By Scladydijewelry

Vtg 1956 Walt Disney S Tomorrowland Rocket To The Moon Disneyland Board Game Disney Board Games Vintage Board Games Disney Toys

2019 2020 Back To School Information For Fort Mill Sc School Information School Site Student Enrollment

This Week S Specials Spicy Crab Roll 1 99 And Happy Hour In Miami Lakes Spicy Crab Roll Spicy Crab Crab Rolls